Flexible Bail Financing: Top 3 Affordable Options 2024

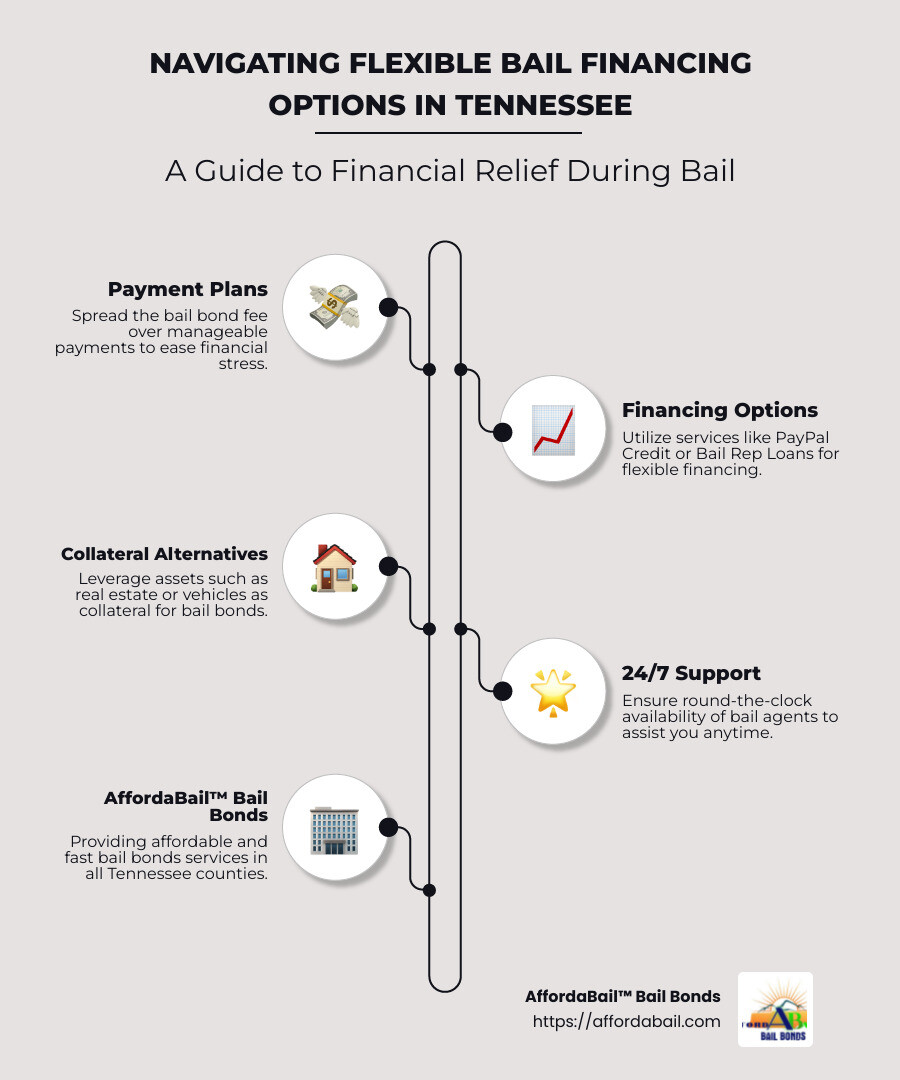

Navigating Flexible Bail Financing in Tennessee

Flexible bail financing can be a lifeline for families in Tennessee who are dealing with the financial stress of a loved one’s arrest. When unexpected legal expenses arise, being informed about your options can make a significant difference. Here’s a quick guide to get you started:

- Payment Plans: Spread the bail bond fee over time.

- Financing Options: Use services like PayPal Credit or Bail Rep Loans.

- Collateral Alternatives: Leverage assets such as real estate or vehicles.

- 24/7 Support: Ensure around-the-clock availability of bail agents.

Getting a bail bond can be a daunting task, especially when finances are tight. The sudden burden of legal fees adds to the stress and anxiety families already face. In Tennessee, which includes all counties and major metropolitan areas, understanding your bail bond options is crucial.

Dealing with bail bonds involves navigating a complex process where financial strain is often unavoidable. Fortunately, there are solutions that offer flexibility and ease. At AffordaBail™ Bail Bonds, we specialize in providing affordable and fast bail bonds services, ensuring that financial constraints don’t keep you from securing the freedom of your loved ones.

Understanding Bail Bonds

Definition and Purpose

A bail bond is a financial arrangement that allows a defendant to be released from jail while awaiting trial. Bail serves as a guarantee that the defendant will appear in court on the scheduled dates. If the defendant fails to show up, the court keeps the bail money, and a warrant is issued for their arrest.

The Process

The bail process in Tennessee begins with an arrest. Once arrested, the individual is taken to a local jail for booking and processing. This includes taking personal details, fingerprints, and checking the criminal record. After booking, the defendant attends an arraignment where the judge sets the bail amount based on factors like the severity of the crime, criminal history, and flight risk.

If the bail amount is too high, the defendant can seek the services of a bail agent or bondsman. The bail agent charges a non-refundable fee, usually a percentage of the total bail amount, to post the bail on behalf of the defendant.

Role of the Bail Agent

A bail agent or bondsman is a licensed individual or agency that provides bail bonds to defendants who cannot afford to pay the full bail amount. In Tennessee, bail bondsmen are regulated by state laws to ensure fair practices. The agent pays the bail to the court, and in return, the defendant (or their family) pays the agent a fee, typically 10% of the bail amount.

Court Appearance

Once released on bail, the defendant must adhere to the conditions set by the court, such as travel restrictions and regular check-ins. The primary condition is to appear at all scheduled court dates. Failure to comply can result in the forfeiture of the bail amount and the issuance of an arrest warrant.

Own recognizance release is an alternative where the defendant is released based on a written promise to return to court, without paying bail. However, this is typically reserved for low-risk individuals.

Factors Influencing Bail Amount

Several factors influence the bail amount set by the judge:

- Criminal history

- Familial and community ties

- Flight risk

- Previous court attendance behavior

- Severity of the crime

- Ability to pay bail

- Mitigating factors

- Bail schedule

Understanding these factors can help you anticipate the potential bail amount and prepare accordingly.

Navigating the bail process can be challenging, especially under financial stress. Flexible bail financing options can make a significant difference, ensuring that financial constraints don’t prevent you from securing your loved one’s release.

Flexible Bail Financing Options

Navigating the bail process can be financially stressful, especially when faced with high bail amounts. Fortunately, flexible bail financing options can help ease the burden. Here are some of the most popular methods available:

AffordaBail™ Payment Plans

AffordaBail™ offers flexible payment plans that allow you to pay over time. With AffordaBail™, you can:

- Choose monthly installments that fit your budget.

- Avoid the need for upfront payment.

- Enjoy peace of mind by managing payments according to your financial situation.

Using AffordaBail™ Payment Plans is straightforward, making it an excellent option for those who need immediate financial flexibility.

AffordaBail™ Bail Loans

AffordaBail™ provides loans specifically for bail bonds and related expenses. This option stands out for several reasons:

- Online application offers quick and easy access to funds.

- There is no risk, no cost, and no obligation to explore your options.

- You can secure financing without the need for collateral or a cosigner.

AffordaBail™ Bail Loans can be a lifesaver when you need fast, reliable funding to cover bail costs.

AffordaBail™ Title Loans

AffordaBail™ Title Loans is another viable option for bail bond financing. This service connects you with lenders who offer auto title loans. Key features include:

- Loan amounts up to $50,000, depending on your vehicle’s equity.

- Low monthly installments with competitive interest rates.

- An easy and simplified application process.

This option is ideal if you own a vehicle and need to leverage its value to secure bail funds quickly.

Benefits of Flexible Bail Financing

Flexible bail financing options offer several advantages:

- Affordability: Spread out payments over time.

- No upfront payment: Avoid large initial costs.

- Asset protection: Keep your valuable assets secure.

- Budget-friendly: Manageable monthly payments to fit your financial situation.

Understanding these options can significantly alleviate the financial stress associated with posting bail. Whether you choose AffordaBail™ Payment Plans, AffordaBail™ Bail Loans, or AffordaBail™ Title Loans, each provides a pathway to secure your loved one’s release without breaking the bank.

Benefits of Flexible Bail Financing

Flexible bail financing options offer several advantages that can make the bail process much more manageable. Here are the key benefits:

Affordability

One of the biggest benefits is affordability. Instead of paying a large sum all at once, you can spread the cost over time. This makes it easier to manage your finances without causing a significant strain. For instance, using services like AffordaBail™ Bail Bonds, you can break down the payments into monthly installments that fit your budget.

No Upfront Payment

Many flexible bail financing options require no upfront payment. This is particularly beneficial if you don’t have immediate access to a large amount of cash. AffordaBail™ Bail Bonds allows you to secure financing without the need for an upfront payment, which can be a lifesaver in urgent situations.

Asset Protection

Flexible financing options help you avoid using your valuable assets as collateral. For example, with AffordaBail™ Bail Bonds, you can secure the necessary funds while keeping your assets safe. This way, you can leverage your financial options without risking important assets like your home or savings.

Budget-Friendly

Lastly, these options are designed to be budget-friendly. They offer manageable monthly payments custom to your financial situation. Whether you choose to pay through AffordaBail™ Bail Bonds’ flexible payment plans, you can find a solution that doesn’t disrupt your financial stability.

These benefits make flexible bail financing an attractive option for many people. By spreading out payments, avoiding upfront costs, protecting your assets, and keeping payments within your budget, you can alleviate much of the financial stress associated with posting bail.

How to Qualify for Flexible Bail Financing

Qualifying for flexible bail financing can be straightforward if you meet certain criteria. Here’s what you need to know:

Credit History

Your credit history plays a crucial role in qualifying for bail financing options. Bail bond companies look for individuals who have a history of paying their bills on time. While perfect credit isn’t necessary, having a record of timely payments can significantly improve your chances of approval.

Employment Status

Being employed is another key factor. Lenders want to see that you have a steady income, which assures them that you can make the required payments. If you have a stable job, you’re more likely to qualify for flexible payment plans.

Cosigner Requirements

If your credit history or employment status isn’t strong, having a cosigner can help. A cosigner is someone who agrees to take on the responsibility of the loan if you fail to make payments. Ideally, this person should have good credit and a stable financial situation. Family members or close friends often serve as cosigners.

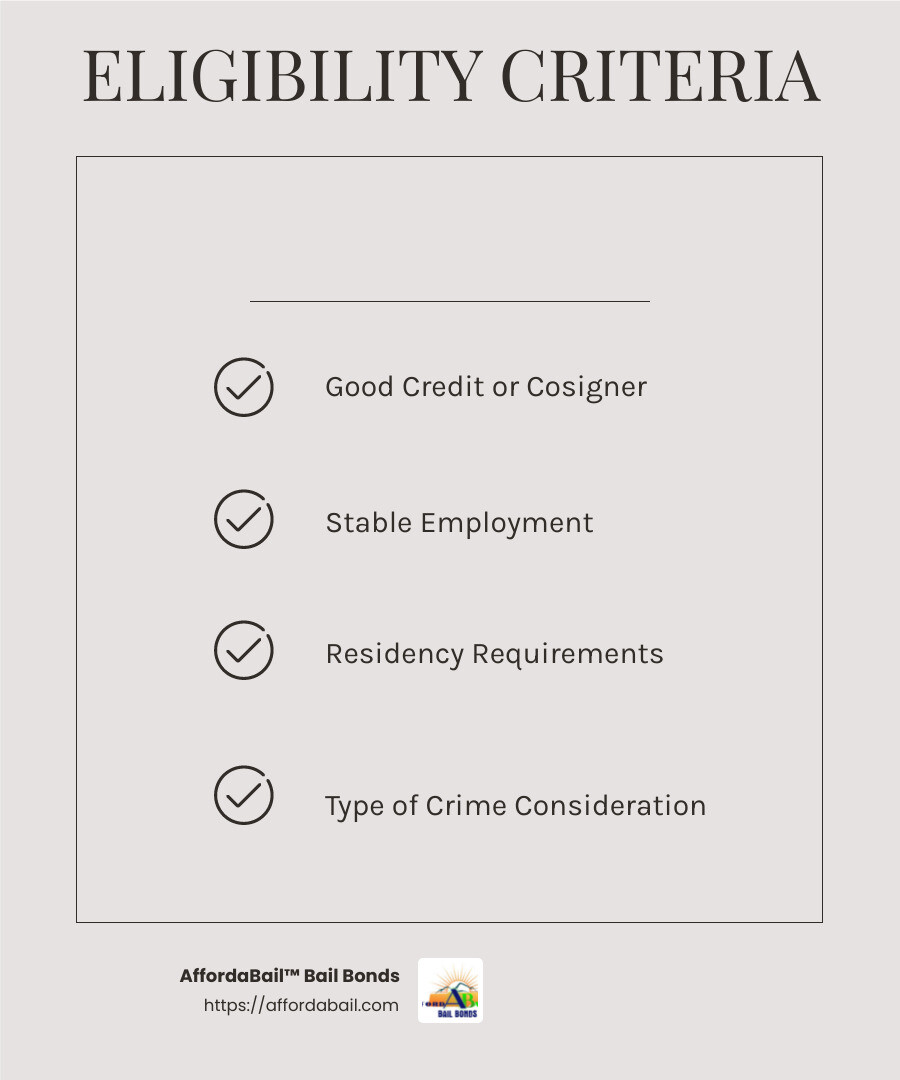

Eligibility Criteria

To qualify for flexible bail financing, you generally need to meet the following criteria:

- Good Credit or Cosigner: As mentioned, either you or your cosigner should have a good credit history.

- Stable Employment: Proof of steady employment can be required.

- Residency: Some companies may require you to have lived in the area for a certain amount of time.

- Type of Crime: The nature of the crime you are charged with can also influence your eligibility. Serious offenses might require higher bail amounts and stricter conditions.

When you call a bail bond company, they can quickly advise you on whether you qualify for financing. The process is usually fast, and you can get an answer within minutes.

Understanding these requirements can help you prepare and increase your chances of securing the financing you need.

Frequently Asked Questions about Flexible Bail Financing

Can you make payments on a bond?

Yes, you can make payments on a bond. Many bail bond companies offer payment plans to make bail more affordable. This means instead of paying the full bail amount upfront, you can pay in smaller, more manageable installments. This is especially helpful if you don’t have immediate access to large sums of money.

How much do you pay for a $1000 bond?

For a $1000 bond, you typically pay a non-refundable fee of 10 percent to the bail bond company. That means you would pay $100. This fee is the bail bond broker’s charge for covering the full bail amount with the court.

What is the lowest percentage for bail bonds?

Some bail bond companies offer plans with as low as one percent down. This means for a $1000 bond, you might only need to pay $10 upfront. However, these plans often come with additional requirements, such as having a stable job or a cosigner. A cosigner is someone who agrees to take responsibility if you fail to make the payments.

Flexible bail financing options can make the process of securing bail less stressful and more manageable. Whether through payment plans or low down payment options, there are solutions to fit different financial situations.

Conclusion

Navigating the bail process can be stressful, but AffordaBail™ Bail Bonds is here to help. We provide fast, reliable, and affordable bail bonds across Tennessee, ensuring you or your loved one can get out of jail quickly.

Our agents are available 24/7 to assist you, no matter where you are in the state. From the busy streets of Nashville to the quiet towns in rural counties, our team is ready to come to you and provide the support you need.

Flexible bail financing is one of our key offerings. We understand that not everyone has the financial resources to pay bail upfront. That’s why we offer various payment plans and financing options to make the process more manageable. Whether you choose PayPal Credit, Bail Rep Loans, or MaxCash Title Loans, we have solutions custom to fit your financial situation.

Our goal is to alleviate the financial stress associated with bail. With AffordaBail™, you can focus on what matters most—being there for your loved ones during challenging times. Trust us to be your steadfast partner, guiding you through the legal process with compassion and expertise.

For more information and immediate assistance, visit our AffordaBail™ Bail Bonds service page.

Experience the AffordaBail™ difference and let us help you regain your freedom.