Flexible Finance Plan: Top 7 Crucial Benefits in 2024

Understanding Flexible Finance Plans

A flexible finance plan offers a valuable way for individuals to manage their finances by spreading out payments over time. Whether you’re dealing with unexpected expenses or managing necessary costs, these plans can provide an adaptable and supportive solution.

Quick Overview:

– What is it? A method that allows customers to pay over time rather than upfront.

– Importance: Helps manage cash flow and reduces financial stress.

– Benefits: Increased financial flexibility, more manageable payments, and a customer-centric approach.

Flexible finance plans have become increasingly popular, especially among millennials and Gen Z, who value payment flexibility. Businesses adapt to this change to better serve customers and boost growth. Offering flexible payment options highlights a customer-centric approach and can significantly increase conversions. As C+R Research notes, more than half of Americans prefer flexible payment services over traditional credit options, proving the value of payment flexibility.

Next, let’s dive into the specifics of flexible finance plans, their components, and how they can benefit both businesses and consumers.

What is a Flexible Finance Plan?

A flexible finance plan lets individuals pay for services over time instead of all at once. This approach can help manage cash flow and reduce financial stress. Flexible finance plans are adaptable, providing financial security and stability to those who need it.

Definition

A flexible finance plan is a method that allows customers to spread out payments over a period of time. It’s similar to a credit card but usually without the high interest rates. These plans can be custom to fit various financial situations, making them a popular choice for many.

Adaptability

One of the key benefits of a flexible finance plan is its adaptability. Plans can be customized based on:

– Repayment Period: Choose from short-term (a few months) to long-term (several years) plans.

– Payment Frequency: Options to pay weekly, bi-weekly, or monthly.

– Customization: Tailor the plan to meet individual financial needs and capabilities.

For example, with services like AffordaBail™ Bail Bonds, clients can create payment plans custom to their preferences, ensuring they can manage their finances effectively while dealing with bail bond payments.

Financial Security

Flexible finance plans can offer financial security by:

– Reducing Immediate Financial Burden: Instead of paying a large sum upfront, you can make smaller, more manageable payments.

– Avoiding High-Interest Rates: Many plans offer low or no interest, especially if payments are made on time.

– Preventing Debt Accumulation: By spreading out payments, it’s easier to manage finances without falling into debt.

Stability

Financial stability is another significant advantage. Flexible finance plans can help:

– Manage Cash Flow: By breaking down payments, you can better plan and manage your monthly budget.

– Cope with Unexpected Expenses: These plans can be a lifesaver when unexpected costs arise, providing a way to handle financial emergencies without immediate strain.

– Maintain Credit Score: Consistent, on-time payments can help maintain or even improve your credit score.

In summary, a flexible finance plan is a practical and supportive financial tool. It provides adaptability, financial security, and stability, making it easier for individuals to manage their finances effectively.

Next, we’ll explore the key components of flexible finance plans, including repayment periods, payment frequency, and customization options.

Key Components of Flexible Finance Plans

Flexible finance plans are designed to make payments more manageable. Here are the key components that make these plans effective:

Repayment Period

The repayment period is the length of time over which you make payments. This can range from a few months to several years. For example, AffordaBail™ Bail Bonds offers plans from 3 months to 48 months, giving businesses and customers the flexibility to choose a period that fits their needs.

Short-term plans (a few months) are ideal for smaller amounts and quick payoffs. Long-term plans (several years) are better for larger sums, offering lower monthly payments but extending the payment duration.

Payment Frequency

Payment frequency refers to how often payments are made. Options typically include:

– Weekly

– Bi-weekly

– Monthly

Choosing the right payment frequency can help manage cash flow. For instance, if you get paid bi-weekly, setting up bi-weekly payments can align with your income schedule, making it easier to budget.

Customization

Customization is a critical feature of flexible finance plans. It allows you to tailor the plan to your specific financial situation. Customizable options include:

– Payment Amount: Adjust the size of payments to what you can afford.

– Interest Rates: Some plans offer interest-free periods or low-interest rates, especially if you have a good credit score.

– Deferred Payments: Option to delay the first payment, which can be helpful in times of financial crunch.

For example, AffordaBail™ Bail Bonds lets businesses create customized payment plans instantly, offering a high level of flexibility to meet customer needs.

Adaptability

Adaptability is what sets flexible finance plans apart from traditional loans or credit cards. These plans can adapt to changing financial circumstances, providing:

– Adjustable Terms: Modify the repayment period or payment amounts if your financial situation changes.

– No Credit Check Options: Some plans, like those from AffordaBail™ Bail Bonds, don’t require a credit check, making them accessible to a broader range of customers.

– Automated Management: Advanced features to automate payment plan management, reducing the administrative burden on businesses.

Real-Life Example

Consider a customer who needs to post bail but cannot afford the lump sum upfront. With a flexible finance plan from AffordaBail™ Bail Bonds, they can spread the cost over several months, choosing a repayment period and payment frequency that fits their budget. This not only alleviates immediate financial stress but also provides a clear path to manage payments without falling into debt.

Next, we’ll explore the different types of flexible finance plans available, including buy now pay later, installment plans, and more.

Types of Flexible Finance Plans

Flexible finance plans come in various forms, each designed to make financial commitments more manageable. Let’s dive into some of the most popular types:

Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) services are rapidly gaining popularity, especially among millennials and Gen Z. According to a 2021 report by C+R Research, 56% of Americans prefer BNPL over credit cards.

BNPL allows customers to split their purchase into smaller, interest-free installments. This method is particularly useful for managing larger expenses without the immediate financial burden.

Pros:

– Allows partial advance payment.

– Frees businesses to focus on other tasks as the recovery of payments is handled efficiently.

Cons:

– Limited flexibility as terms are predefined.

– Less opportunity to build direct customer relationships.

Installment Plans

Installment Plans provide a structured way to pay off larger sums over time. These plans often come with customizable terms, allowing for adjustments based on individual financial needs.

Pros:

– High customization options.

– Less stringent credit checks.

– Hassle-free approvals and automated management.

Cons:

– Not ideal for services costing less than a certain amount, ensuring it’s used for significant expenses only.

Adjustable-Rate Mortgages (ARMs)

Adjustable-Rate Mortgages (ARMs) are commonly used for home financing. They offer a lower initial interest rate that adjusts periodically based on market conditions.

Pros:

– Lower initial interest rates compared to fixed-rate mortgages.

– Beneficial if market interest rates decrease.

Cons:

– Payments can increase if interest rates rise.

– Requires careful monitoring of market conditions.

Flexible Bail Bond Payments

Flexible Bail Bond Payments are crucial for those needing immediate assistance. These plans allow clients to pay their bail bond fees in smaller, more manageable amounts over time, rather than a single lump sum.

Pros:

– Helps manage cash flow and avoid late fees.

– Provides financial flexibility for clients in a stressful situation.

Cons:

– May come with additional service fees.

– Requires coordination with bail bond agents.

Next, we’ll discuss the benefits of flexible finance plans, from managing cash flow to avoiding high-interest rates.

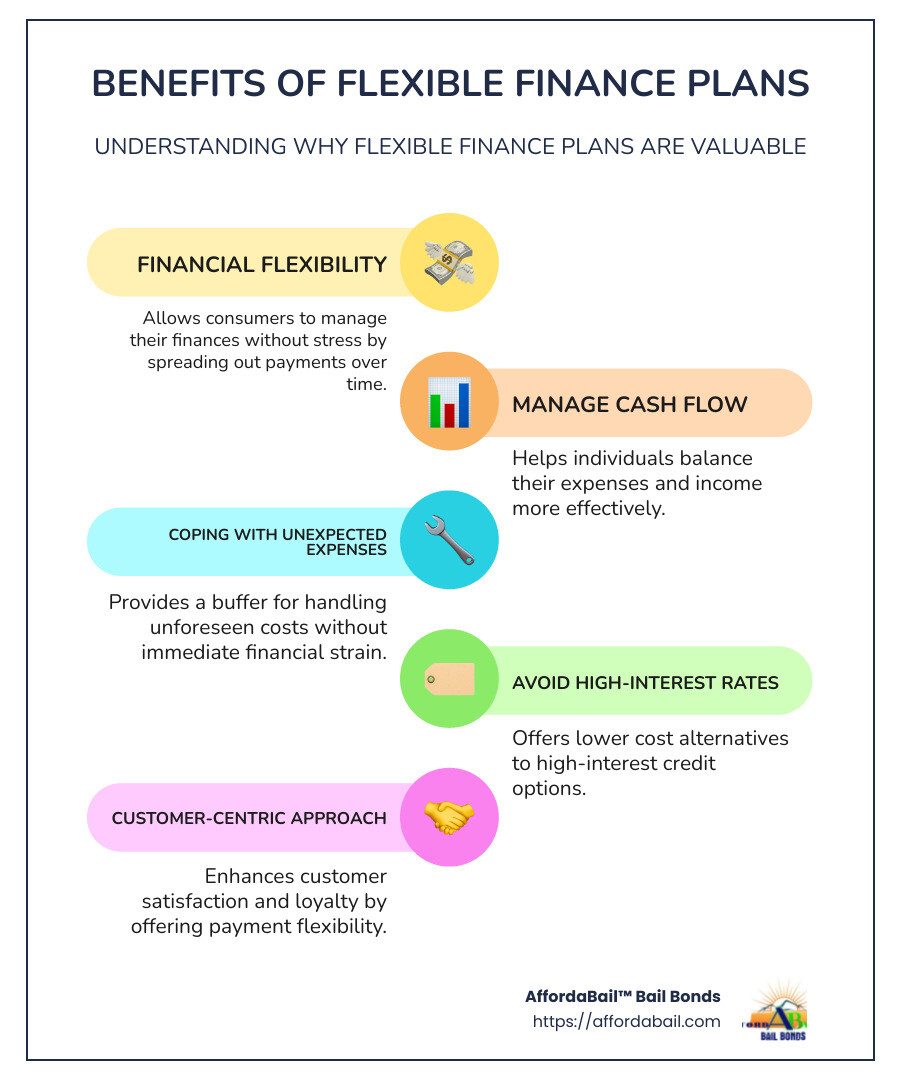

Benefits of Flexible Finance Plans

Flexible finance plans offer numerous advantages that can make managing finances much easier, especially during tough times. Let’s explore some key benefits:

Financial Flexibility

A flexible finance plan allows you to adjust payments based on your financial situation. For example, with AffordaBail™ Bail Bonds, you can spread out your bail payments over time, making it easier to handle large expenses without immediate financial strain.

Managing Cash Flow

One of the biggest benefits of flexible finance plans is improved cash flow management. Instead of paying a large sum upfront, you can make smaller, manageable payments each month. This helps you keep more money in your pocket for other essential expenses, such as groceries, utilities, and legal fees.

Coping with Unexpected Expenses

Life is full of surprises, and not all of them are pleasant. A flexible finance plan can be a lifesaver when unexpected expenses arise. Whether it’s a sudden medical bill or an emergency home repair, having the option to pay over time can alleviate stress and provide peace of mind.

Avoiding High-Interest Rates

High-interest rates can quickly turn a manageable debt into a financial nightmare. Many flexible finance plans, like those offered by AffordaBail™, come with lower or even zero interest rates, especially if you have a good job or own your home. This can save you a significant amount of money in the long run.

Real-World Example: Bail Bonds in Tennessee

Consider the case of John, who was arrested in Nashville and needed to post bail. The bail amount was $5,000, which he couldn’t afford to pay all at once. By opting for a flexible finance plan with AffordaBail™ Bail Bonds, John was able to pay a small down payment and set up monthly installments. This not only helped him secure his release but also allowed him to manage his finances better while dealing with legal expenses.

Next, we’ll explore the risks and considerations you should keep in mind when opting for flexible finance plans.

Risks and Considerations

While flexible finance plans offer many benefits, they also come with certain risks and considerations. It’s important to understand these before committing to a plan.

High-Interest Rates

For those with poorer credit, flexible finance plans can come with high-interest rates, sometimes up to 30%. This can significantly increase the total amount you end up paying. For example, if you’re using a flexible finance plan to cover bail bonds, a high-interest rate could make your payments much harder to manage over time.

Late Fees

Missing a payment can result in hefty late fees. These fees can quickly add up, making it even more difficult to keep up with your payments. In some cases, missing a payment can also void any interest-free period you might have had, leading to even higher costs.

Potential Debt

Flexible finance plans can sometimes lead to accumulating debt. If you’re already struggling to make ends meet, taking on more debt can exacerbate your financial situation. This is especially true if you have multiple flexible payment plans running simultaneously.

Credit Score Impact

Your credit score can be significantly impacted by how you manage your flexible finance plan. Late payments, missed payments, and high balances can all hurt your credit score. A lower credit score can make it harder to get loans or credit cards in the future and may even affect your ability to rent an apartment or get a job.

Real-World Example: Bail Bonds in Tennessee

Consider the case of Sarah, who needed to post bail for her brother in Memphis. She opted for a flexible finance plan but missed a few payments due to unexpected medical bills. The late fees and high-interest rates quickly added up, putting her in a difficult financial position. Her credit score also took a hit, making it harder for her to secure a loan for other necessities.

Next, we’ll explore how flexible finance plans work specifically in the context of bail bonds with AffordaBail™ Bail Bonds.

How Flexible Finance Plans Work in Bail Bonds

When dealing with the legal system, financial stress can quickly escalate. This is where AffordaBail™ Bail Bonds steps in, offering flexible finance plans to help alleviate some of that burden. Here’s how these plans can make a difference:

Bail Bond Financing

AffordaBail™ Bail Bonds understands that not everyone has the funds to pay bail upfront. That’s why they offer bail bond financing options. This means you can secure a bail bond without having to pay the entire amount at once. Instead, you can spread the cost over a manageable period.

Flexible Payment Options

One of the standout features of AffordaBail™ Bail Bonds is their commitment to flexible payment options. These plans are custom to fit your financial situation, allowing you to make smaller, more manageable payments over time. This flexibility can be crucial, especially when faced with unexpected legal expenses.

Financial Stress Alleviation

By providing flexible finance plans, AffordaBail™ Bail Bonds helps reduce the immediate financial strain of posting bail. For example, if you’re in Nashville and need to post bail, a flexible plan can mean the difference between financial stability and significant debt. This approach ensures that you can focus on what’s important—supporting your loved one through their legal process—without the added stress of financial worries.

Real-World Impact

Consider the case of John, who needed to post bail for his son in Knoxville. With AffordaBail™ Bail Bonds’ flexible finance plan, he was able to break down the bail amount into smaller, more manageable payments. This not only eased his financial burden but also allowed him to maintain his household budget without major disruptions.

By offering these flexible finance options, AffordaBail™ Bail Bonds provides a lifeline to families during challenging times. Their 24/7 availability across Tennessee ensures that help is always at hand, no matter when you need it.

Next, we’ll dive into some frequently asked questions about flexible finance plans to help you understand how they can benefit you.

Frequently Asked Questions about Flexible Finance Plans

What is a flexible financial plan?

A flexible financial plan allows you to adapt your payments according to your financial situation. This adaptability provides financial security and stability, especially during tough times. For instance, if you suddenly face unexpected expenses, a flexible financial plan can help you manage those costs without derailing your budget.

What is flexible financing?

Flexible financing refers to options that allow you to customize your repayment terms. This could mean adjusting your repayment period, choosing different payment frequencies, or opting for alternative financing methods. These features make it easier to manage your finances according to your income flow and financial commitments.

What is a flexible payment plan?

A flexible payment plan is a type of financing that lets you pay for a purchase over time. This could be through buy now, pay later (BNPL) services, installments, or other methods. For example, you might choose a BNPL option to split a large purchase into smaller, interest-free payments over a few months.

Interest rates can vary depending on the plan you choose. Some plans offer interest-free periods, while others may have fixed or variable rates. The key is to find a plan that aligns with your financial needs and capabilities.

By understanding these flexible finance options, you can make more informed decisions and better manage your financial obligations. Next, we’ll explore how these plans work specifically in the context of bail bonds.

Conclusion

Navigating the complexities of the bail bond process can be challenging, but with AffordaBail™ Bail Bonds by your side, you gain a reliable partner committed to easing your financial stress. Our flexible finance plans are designed to provide you with the adaptability you need during tough times.

Since 2016, AffordaBail™ has been a premier provider of bail bond services across Tennessee. We offer 24/7 service, ensuring that you or your loved one can get out of custody quickly, no matter the time of day. Our dedicated and experienced team of licensed agents is always ready to guide you through every step of the legal process, providing the transparency and care you deserve.

Our flexible payment options are custom to meet your specific needs, making it easier for you to manage your financial obligations without the burden of high-interest rates or rigid payment schedules. Whether you’re in a major metropolitan area or a smaller community, our agents are conveniently located throughout the state to provide swift and comprehensive support.

AffordaBail™ Bail Bonds is committed to offering affordable, fast bail bonds services, ensuring your freedom is our top priority. Trust us to be your steadfast partner during challenging times, providing the expertise and coverage you can count on across Tennessee.

For more information and immediate assistance, visit our AffordaBail™ Bail Bonds service page.

Experience the AffordaBail™ difference today and let us help you get back to what matters most.